What Motor Insurance cover should I buy? Should I buy Comprehensive Insurance or Liability Policy only?

Third-Party Liability Insurance is mandatory for all vehicles plying on public roads in India. However, if you are confused between comprehensive and liability only insurance, it is better if you first understand what each type of insurance offers.

- Comprehensive or Package insurance covers damage to others as well as your vehicle, including property damage and bodily injuries. It is also known as fully comp insurance.

- Liability only insurance covers damages and injuries caused to others by your vehicle. Any damage to your vehicle is your own problem. It is also known as Act only insurance.

It is best to buy a Comprehensive Package Policy, which covers both ‘Own damage’ along with ‘Third-Party Liability’. Some insurance providers also offer additional riders for maximum protection at a nominal fee.

What coverage limit meets my needs?

Motor insurance coverage requirement varies from person to person and vehicle to vehicle. Most insurance companies typically provide unlimited coverage for Third-Party Injuries and upto a sum of INR 750,000 for Third-Party Property Damage. However, if you want to get a lower ‘Liability only’ premium, you have the option to restrict coverage for Third-Party Property Damage to INR 6,000. Further, since different insurance companies provide different features for similar coverage, you can settle on the one that offers the most competent premium rates and riders as per your needs and capability.

What is the period of the policy?

A motor policy is usually valid for a period of one year and has to be renewed before the due date. No Insurer currently offers a grace period for paying the premium. So, it is important to pay the premium on time. In case of lapse of policy by even one day, your vehicle will have to be inspected again by the insurance company.

Additionally, you will lose the accumulated benefit of NCB (No Claim Bonus) if you have a lapse for more than 90 days in your comprehensive policy.

What is ‘No Claim Bonus’?

No Claim Bonus (NCB) is a form of reward for you (the vehicle owner) for not making any claims during the policy period. It helps you get a significant discount on premium during renewal. However, most insurance companies in India consider NCB of minimum 5 years when working out a discount. It is likely to get you a discount in the range of 20 to 50% on own-damage or comprehensive premium. It is not applicable on Liability only premium.

If, however, a claim is lodged, No Claim Bonus is lost in the subsequent policy period.

Further, NCB is given to you (the insured) and not to the insured vehicle. Hence, on transfer of the vehicle, the insurance policy will be transferred to the new owner but not the NCB. You as the original owner can, however, use the NCB on a new vehicle purchased.

What if I want to change my insurance company? Will my No Claim Bonus get migrated?

Yes. You can get your NCB migrated if you change your insurer on renewal. However, you will need a proof of the NCB earned. You can get it by asking for a renewal notice or a letter confirming NCB entitlement from the previous insurer.

Alternatively, you can produce your original, expiring policy along with a certification that you have lodged no claims on the expiring policy.

What is deductible?

Motor insurance deductible (also known as ‘excess’) is the amount of money that you have to pay toward repairs or other bills before your insurance company covers the rest. For example, if you have an accident that causes INR 5,000 worth of damage and your deductible is INR 1,000, you will have to pay INR 1,000 toward the repair. Your insurance company will pay the remaining INR 4,000.

Further, there is a compulsory deductible in motor insurance covers as follows:

- INR 100 for motorized two wheelers

- INR 1,000 for private vehicles not exceeding 1500cc

- INR 2,000 for private vehicles exceeding 1500cc

You can also apply for voluntary deductibles in your vehicle insurance plan for possible discount on premium. However, do check with your insurance company regarding their discount offers before applying.

What is the procedure for recording any changes in the policy?

If you want to record any changes, you can do so by getting an endorsement on your insurance policy. The changes may include:

- Change of Address

- Modifications to the vehicle

- Modifications to the purpose of use etc.

You have to submit a letter to the insurer along with proof of changes in order to obtain the endorsement. You may also have to pay additional premium for some endorsements. Also, do check the accuracy of endorsement before accepting.

What is a Certificate of Insurance under Motor Vehicle Act?

Certificate of Insurance is a document issued by your insurer showcasing all the details of your effective insurance plan for your vehicle.

As per Rule 141 of the Central Motor Vehicle Rules 1989, it is mandatory for your insurer to issue a Certificate of Insurance along with the policy document at the time of purchase or renewal. In addition to this, the certificate must be issued in the format laid down in Form 51 as given under the Motor Vehicle Rules.

You must always carry this certificate in your vehicle. It is required for any sort of police inspection along with other important documents such as your driving license. It is also advisable to keep a copy separately at home or office.

What are the documents to be kept in the vehicle while plying in public places?

You must always carry the following documents while plying in public places:

- Certificate of Insurance

- Xerox copy of Registration Certificate

- Pollution under Control Certificate

- Photocopy of Your Driving License

What are the documents that need to be submitted for a Motor Insurance claim?

You are required to submit the following documents when making a Motor Insurance claim:

- Duly filled-in claim form

- RC copy of the vehicle

- Original estimate of loss

- Original repair invoice and payment receipt.

In case you want to avail cashless facility, only the repair invoice would be needed. You may also be asked to submit an FIR in case of theft.

In case of a pure theft claim, you will have to submit the keys of the vehicle as well along with the FIR and a non-traceable certificate.

How is the premium determined?

Third-Party Liability (only premium) rates are laid down by IRDA.

In case of own damage or comprehensive insurance covers, various factors are used to determine the payable premium for your motor insurance. Further, different insurance companies may provide different coverage, deductibles and IDV for the same vehicle after duly filing rates with the Insurance Regulatory and Development Authority. There may also be a significant difference in premium rates offered for similar coverage by different insurance companies. So, it is best to compare three or more insurers before buying a policy.

You can use the 5nance platform to get a list of offers from various insurance companies in one place. You will need the following information:

- Vehicle registration details with Engine No. (Used to calculate Insured Declared Value or IDV)

- Chassis No.

- Class and Age of vehicle

- Cubic Capacity

- Seating capacity (All relevant details are in the RC book/card)

- Tax paid details

- Certificate of fitness

- Driver Details

- Age

- Gender

- Qualifications

- License Validity

- Previous insurance history, if any.

In case of break in insurance, vehicle inspection is required and extra charges may be incurred for the same.

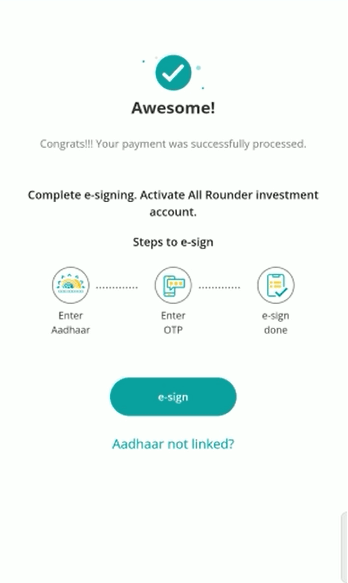

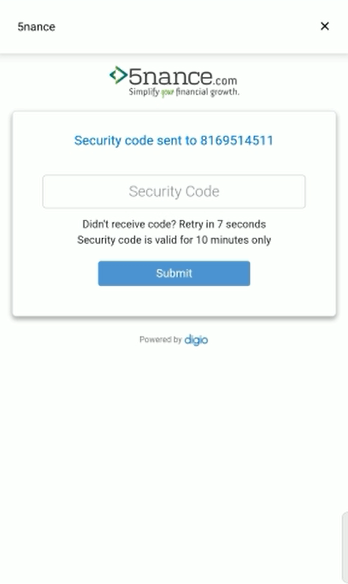

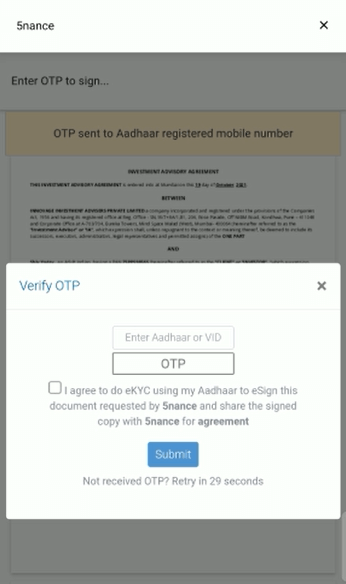

How to get your vehicle insured

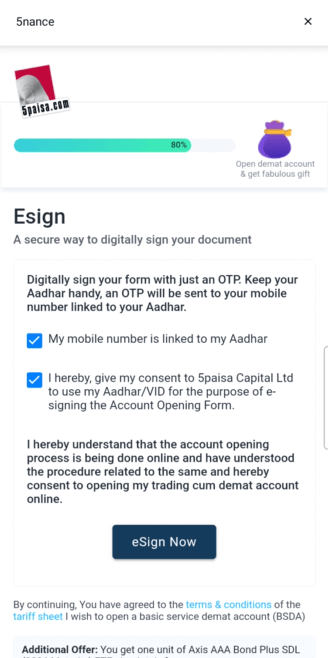

- Log onto 5nance.com

- Get quotes for Motor Insurance

- Select the product, you need (two-wheeler, car insurance)

- Pay at the Insurer Payment Gateway

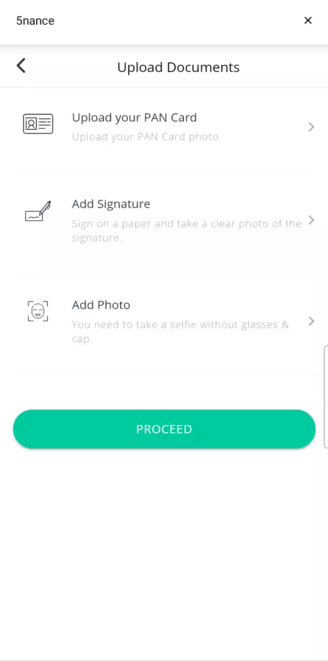

- Fill the Proposal Form, upload the documents

- Your Policy gets issued

Are there any discounts that will lower my premium?

Insurance companies in India offer discounts on motor insurance premium for the following:

- Membership of ARAI (Automobile Association of India)

- Vintage Cars (Or Private cars certified by the Vintage and Classic Car Club of India)

- Specially designed or modified vehicles for the blind, handicapped or mentally challenged individuals

- Installation of Anti-Theft Devices approved by the ARAI

- Impressive Credit Score

- Long-Time Customers

- Higher Deductibles

- Low Annual Mileage

- Voluntary Deductibles

- More than one vehicle

- No accidents in a period of over 3 years

It is important to remember that different insurance companies have different criteria and discount offers. So, it is best to check with your insurance provider directly to avoid any confusion.

Is Service Tax applicable and how much is it?

Yes. Service Tax is applicable on all motor insurance policies. It is as per the prevailing rule of law.at any given time.

If I am using the car in a particular city, what premium rate is applied?

The premium rate applicable on a vehicle is reckoned on the basis of city of registration (not the place where the vehicle is used).

For example, if your vehicle is registered in Chennai in Zone A, the rate applicable for Zone A is charged. The same rate will be applicable even if you shift to a different city / town.

Similarly, if a vehicle is registered in a town in Zone B, it will attract Zone B premium rates. Subsequently if the owner shifts to a metro, he will continue to be charged the Zone B rate.

Is it necessary to inform the Insurance Company if I fit CNG or LPG kit in my vehicle?

Yes. Insurance companies usually have a clause on CNG and/or LPG conversion. So, it is necessary to inform the Insurance Company if you fit a CNG or LPG kit in your vehicle. As it is considered as a major modification to the vehicle, it has to be endorsed in your insurance policy. If you fail to do so, your entire policy will be nullified at the time of the claim.

You must also notify the RTA (Road Transport Authority) office where your vehicle is registered. It is crucial for the accurate updation of the registration certificate (RC) of the vehicle.

Can I transfer my insurance to the purchaser of my vehicle?

Yes. You can transfer your insurance to the buyer of your vehicle. However, the new owner will have to submit a proof of transfer (in writing from the seller-You) to the insurance company along with a fresh proposal form. He will also have to pay a nominal fee for transferring your insurance. This includes pro-rata recovery of NCB from the date of transfer till policy expiry.

Can I continue the insurance in the name of the previous owner even after the vehicle is transferred in RTO records in my name?

No. Registration and insurance of the vehicle should always be in the same name and with the same address. The claim is not payable otherwise.

Besides, there is a nominal fee charged for transfer of insurance, which includes pro-rata recovery of NCB from the date of transfer till policy expiry. You simply need to submit a fresh proposal form along with a proof of transfer from the previous owner.

Further, it is mandatory to record the transfer of ownership within 14 days from the date of transfer in case of comprehensive/package policies. If you fail to do so, no claim will be payable to for own damage to the vehicle.

I have lost the insurance policy. Can I get a duplicate one?

Yes. You can easily get a duplicate copy by approaching the same office that issued your original insurance policy. You may have to submit a written request and pay a nominal fee for the same.

Which are the motor insurance partners that’re associated with 5nance?

- New India Assurance

- Bajaj

- HDFC Ergo

Algrow Renewal Pending

Your subscription for Algrow will be terminated soon.

Algrow Renewal Pending

Your subscription for Algrow will be terminated soon.

Allsmart Renewal Pending

Your subscription for Allsmart will be terminated soon.

Allsmart Renewal Pending

Your subscription for Allsmart will be terminated soon.