What Is Multi-Asset Investing & Why It Matters in Today’s Market?

When markets are unpredictable, sticking to just one kind of investment—like only equity or only gold—can feel risky. That’s where multi-asset investing comes in.

It’s not just a buzzword. It’s a strategy that gives your money a better chance to grow, stay protected, and remain steady—especially when the market swings hard in either direction.

In this blog, we’ll break down:

-

What Multi-asset Investing means

-

Why it matters now more than ever

-

How it compares to Traditional Investing

-

How AI-led portfolios like All Rounder by 5nance make it easy for anyone to get started

What Is Multi-Asset Investing?

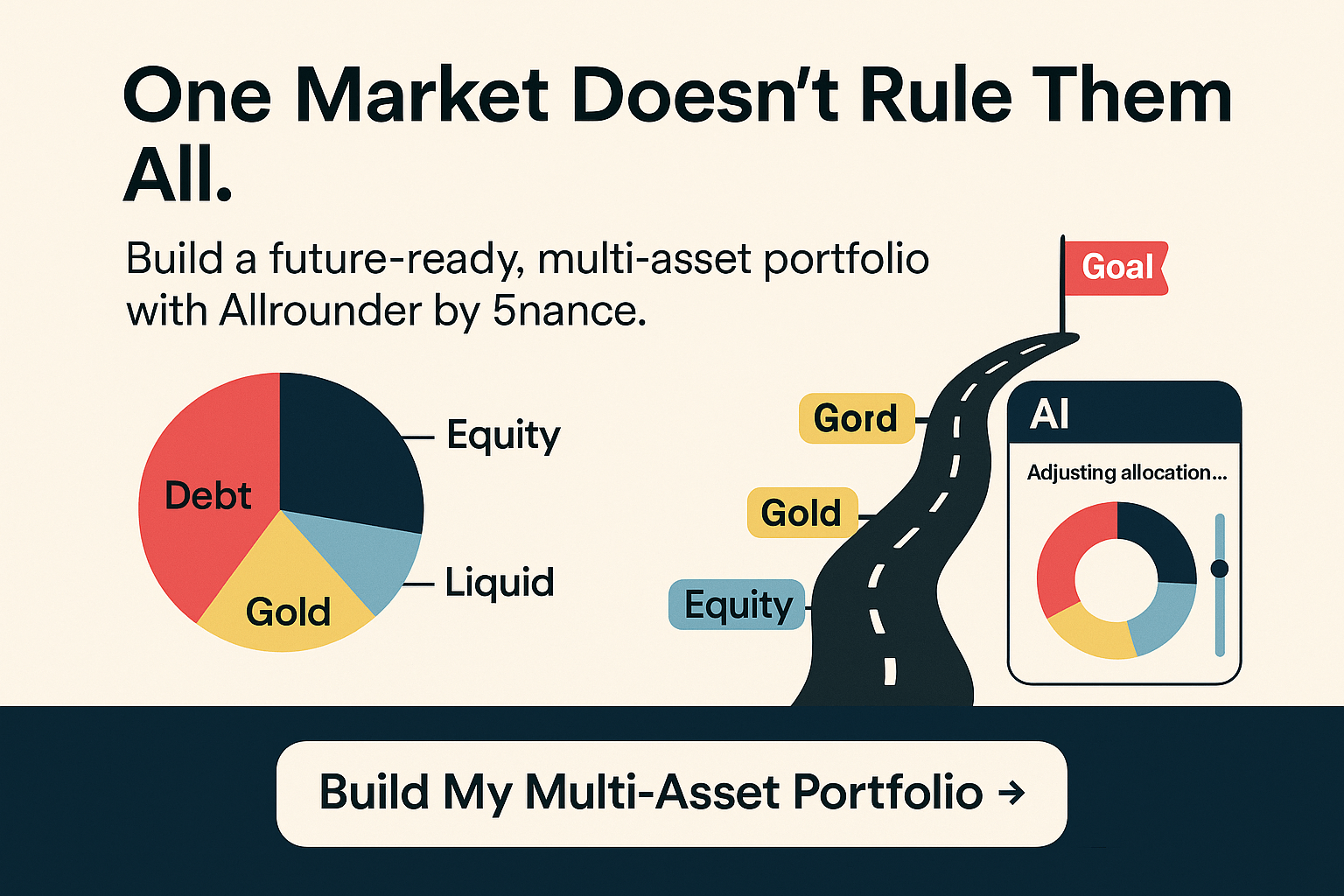

In simple terms, multi-asset investing means putting your money into more than one type of investment (or “asset class”) instead of just one.

Here’s what that can include:

-

Equity – Shares of companies (higher risk, higher reward)

-

Debt – Bonds or fixed-income instruments (steady, safer)

-

Gold – A traditional hedge against uncertainty

-

Cash/Liquid funds – For emergency access or short-term needs

-

Other alternatives – Like real estate or commodities, NASDAQ 100 (optional)

Rather than putting all your eggs in one basket, you spread your money across different baskets—so even if one is hit, the others can balance things out.

Why Does Multi-Asset Investing Matter Now?

The last few years have shown just how unpredictable markets can be. Here’s why a multi-asset strategy makes more sense today than ever:

1. Market Volatility Is the New Normal

Global events like COVID-19, interest rate hikes, inflation shocks, wars, trade tarrifs and supply chain issues have caused frequent ups and downs across all major stock markets.

According to NSE data, the India VIX (volatility index) often spikes above 15–20 during uncertainty, making it risky to rely on equity alone.

2. No Single Asset Always Wins

In some years, equity leads. In others, debt or gold outperforms. For instance:

-

In 2022, gold gave +14% returns, while equity dropped.

-

In 2023, equity bounced back, while gold stayed flat.

A multi-asset portfolio balances out these shifts—reducing risk and improving consistency over time.

3. Goal-Based Investing Needs Stability

If you're saving for a child’s education in 5 years, or retirement in 15, you can’t afford wild fluctuations. You need:

-

Steady growth

-

Downside protection

-

Timely rebalancing

Multi-asset strategies offer all three.

Multi-Asset vs Traditional Investing

|

Feature |

Traditional Investing |

Multi-Asset Investing |

|

Asset focus |

Usually one (e.g., only equity) |

Combines 2+ asset classes |

|

Diversification |

Low |

High |

|

Risk exposure |

Higher (concentrated) |

Balanced (spread out) |

|

Volatility |

High |

Lower |

|

Rebalancing |

Manual (if any) |

Regular (especially with AI tools) |

|

Best for |

Short-term rallies |

Long-term, goal-based investing |

How AI Makes Multi-Asset Investing Easier

Most people don’t have the time, tools, or knowledge to manage a multi-asset portfolio by themselves. That’s where AI-powered investing platforms like All Rounder by 5nance help.

All Rounder simplifies it for you by:

-

Curating the right mix of equity, debt, gold, and liquid funds based on your goal

-

Rebalancing monthly so your allocation doesn’t drift

-

Adjusting to market shifts using real-time data

-

Keeping your risk in check, automatically

You just need to:

-

Set your goal (retirement, home, etc.)

-

Choose your SIP amount (start as low as ₹10,000/month)

-

Let the AI handle everything from there

Real-Life Example: Meet Raj

Raj is a 32-year-old salaried professional investing ₹10,000/month.

Old approach: He picked an equity fund SIP in 2020. In 2022, markets crashed, and he paused his SIP—missing the rebound.

New approach: In 2024, Raj switched to All Rounder. Now:

-

When markets go up, he benefits from equity growth

-

When they fall, his portfolio shifts more to debt/gold

-

He doesn't panic or pause—because it’s handled for him

The result? Steady returns, fewer shocks, and progress toward his goals.

Benefits of Multi-Asset Investing with Allrounder

✅ Automatic diversification

✅ Smarter risk control

✅ AI-based decision making

✅ Monthly health checks & fund switching

✅ Peace of mind—even when markets are volatile

Final Thoughts: Smarter Investing for a Smarter World

Gone are the days when one SIP into one equity fund was enough. Here’s why Traditional SIP might not be enough in 2025.

In 2025, with rising volatility, smarter tools, and evolving goals, multi-asset investing is no longer optional—it’s essential.

With platforms like All Rounder by 5nance, you don’t need to be an expert. You just need to start.

✅ Ready to Invest Smarter?

-

Begin with as low as ₹10,000/month

-

Let AI diversify and rebalance your money

-

Track all your goals, all in one place